OUR GROUP

sales, Trading and research

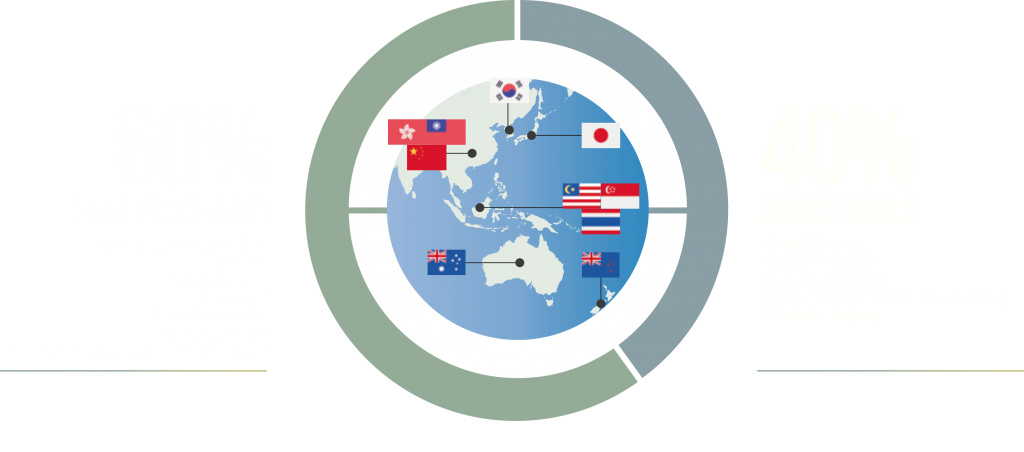

FSHK provides comprehensive sales, trading and market making platform to our individual, business and institutional Partners. The platform comprises wide range of asset classes including but not limited to stocks, bonds, structured products, mutual funds. Our market reach is global in nature, including Hong Kong, NYSE and NASDAQ in the United States, London, Japan, Taiwan, China, Thailand, Singapore, Australia and other markets. Our team constantly works to find new forms of financial investment and solutions to generate superior returns. We have a dedicated team to provide investment research spanning various asset classes and across multiple geographies to support our sales and trading operations

sales, Trading and research

FSHK has an in-house team, supported by multiple external relationships to offer third party distribution services to our global network of hedge fund, private equity, other alternative asset managers as well as direct opportunities. Our private placement and fund advisory platform combines strong global deal origination capabilities, backed by deep high net worth, family offices and institutional relationships across Asia Pacific

Wealth management and multi-familiy office

Wealth in Asia has a broad definition, representing different meanings to individuals, families and across generations. At CGM, 70+ team of relationship managers and planners are expertly equipped to work with these stakeholders to define, plan portfolios and execute on investments and allocation ensuring various goals of wealth appreciation, retirement, family protection, funding of children education or even preserving family legacy

multi-family office

Our multi-family office team at FCGM are able to provide bespoke solutions for Asian families that have assets across different geographies and across different asset classes such as operating businesses, real estate and investments. Some of these services include:

ASSET PROTECTION AND PRESERVATION

Trust and other forms of structuring to ensure family assets are safely protected and sustainably transferred across generations

ASSET PORTFOLIO APPRECIATION AND TAX PLANNING

Structuring and planning of assets and investments across geographies and asset classes will due consideration of tax implications to ensure overall capital appreciation

SEMI OPERATING ROLES FOR FAMILY BUSINESS

Working with owners to restructure family businesses to transition it to cater for current industry and economic environment including mergers and acquisitions, asset divestment and/or diversification strategies

ASSET PROTECTION AND PRESERVATION

ASSET PORTFOLIO APPRECIATION AND TAX PLANNING

SEMI OPERATING ROLES FOR FAMILY BUSINESS

Trust and other forms of structuring to ensure family assets are safely protected and sustainably transferred across generations

Structuring and planning of assets and investments across geographies and asset classes will due consideration of tax implications to ensure overall capital appreciation

Working with owners to restructure family businesses to transition it to cater for current industry and economic environment including mergers and acquisitions, asset divestment and/or diversification strategies

Asset management

The FFH Group established FCGM as an alternative financial, provide asset management services and multi-family office to complement our wealth management operations by offering additional custodian selection. Today, our asset management platform comprise both in-house and third party fund managers across many different investment strategies and structures

Alternative Investment Platform

Witnessing a Asian trend of increasing capital allocation to alternative strategies, our Group further strengthened its alternative investment offerings by establishing a strategic relationship and minority stake in HV2. HV2 is a borderless digital investment and distribution platform to allow investors to access various hedge fund and private equity fund strategies HV2 is unique in that it offers wealth managers, asset managers and investors a marketplace like simple platform integration, data support to drive investment selection and a one stop digital ainvestment selection process

OTHER financial related services

INSURANCE

Our insurance brokerage platform complements our wealth management and multi-family office operations by providing a comprehensive selection of investment linked, life and medical insurance plans from renowned providers such as AIA, AXA, China Life, MassMutual, Fubon Life, TransAmerica and MetLife etc